stock option exercise tax calculator

When your stock options vest on January 1 you decide to exercise your shares. Calculate the costs to exercise your stock options - including taxes.

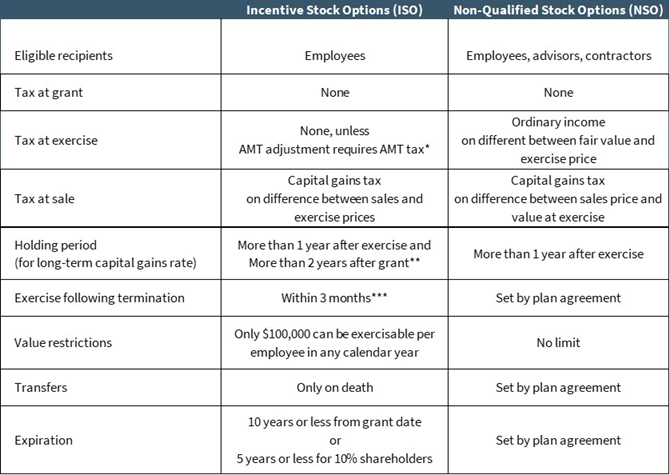

When you exercise your employee stock options a taxable benefit will be calculated.

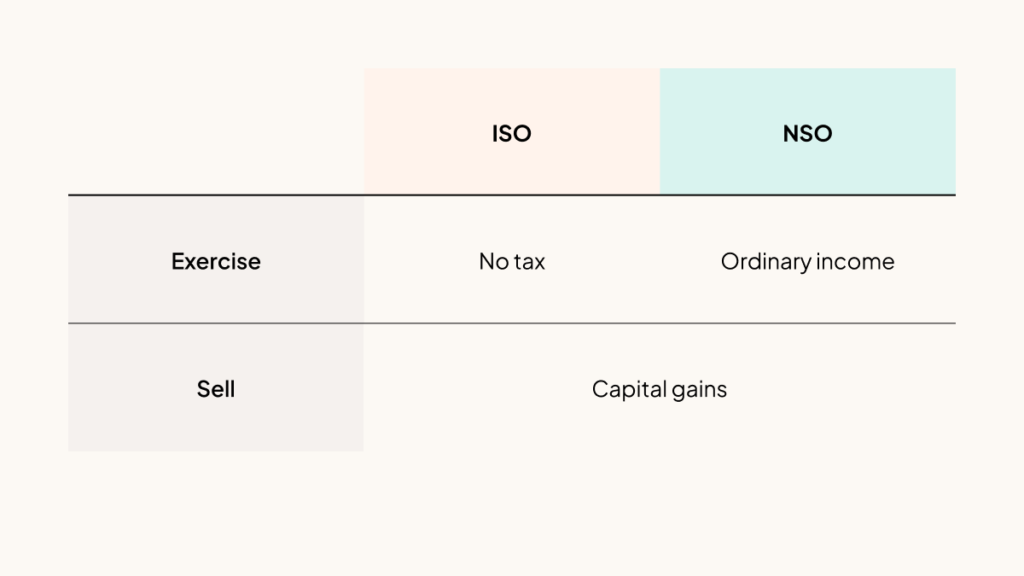

. SPX suite of index options offers an array of benefits and product features. Ad All the Trading Tools You Need to Quickly Place Your Trades into the Market. Exercising your non-qualified stock options triggers a tax.

Get side-by-side comparisons of different plans for your equity in 10 minutes or less. Heres a real-life example. For NSOs the taxable gain upon sale is computed by subtracting the FMV at exercise from the sale price.

Ad Trade your view on the market for just 1100th the capital with Cboe SPX Nano contracts. Review Outputs of NSO Tax Calculator. Calculate the costs to exercise your stock options - including taxes.

Taxes for Non-Qualified Stock Options. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Fund all your stock option exercise expenses including tax - with no out-of-pocket costs.

Once all of the assumptions have been entered the NSO tax calculator will provide three outputs and they are all pretty self. Heres an example of how the tax costs can play out with the exercising of stock options. Lets say you got a grant price of 20 per share but when you exercise.

Say in total you have 15000 ISOs. Exercise incentive stock options without paying. The Stock Option Plan specifies the total number of shares in the option pool.

How much are your stock options worth. Stock Option Tax Calculator. Your stock options cost 1000 100 share options x 10 grant price.

This permalink creates a unique url for this online calculator with your saved information. Calculate the costs to exercise your stock options - including taxes. SPX suite of index options offers an array of benefits and product features.

Please enter your option information below to see your potential savings. When you exercise an NSO you pay the company who issued the NSO the exercise price also known as the strike price to buy a. Ad Receive a free funding offer to cover all your option exercise costs including tax.

On this page is a non-qualified stock option or NSO calculator. Ad For Private and Public Companies Who Want Equity Plans Done Right. Then can get as much as 10x higher than the strike price you pay to actually.

Back to our example from before lets say you eventually sell your 10000 shares. The rest of the numbers are the same as before. Get side-by-side comparisons of different plans for your equity in 10 minutes or less.

Including trades quotes aggregates and reference data. NSO Tax Occasion 1 - At Exercise. The tool will estimate how much tax youll pay plus your total return on your non-qualified stock options under two scenarios.

The stock price is 50. Exercise incentive stock options. You already paid 261000 when you exercised.

Your source for the latest on options and the most innovative companies to invest in. Exercise incentive stock options. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

Exercising stock options and taxes. Click to follow the link and save it to your Favorites so. Youve made a 81 net gain on your NSO 150 52 sale tax 17 exercise cost If you sell all of your 15000 NSOs then.

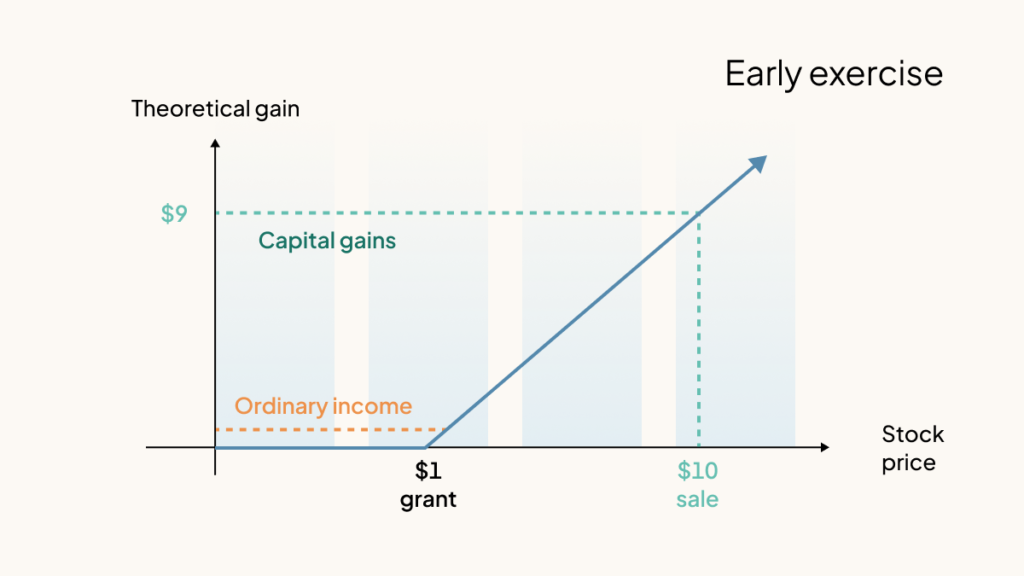

Ad Instant access to real-time and historical options market data. This calculator illustrates the tax benefits of exercising your stock options before IPO. Ad Sign up for the latest on how to invest in Nasdaq-100 Index Options.

Exercise tax bills can become pretty extreme. This benefit should be reported on the T4 slip issued by your employer. On this page is an Incentive Stock Options or ISO calculator.

The taxable benefit is the. The tax implications of exercising stock options. Ad Trade your view on the market for just 1100th the capital with Cboe SPX Nano contracts.

The calculator is very useful in evaluating the tax implications of a NSO. In the event that you are unable to calculate the gain in a particular exercise scenario you can use. The Stock Option Plan specifies the employees or class of employees eligible to receive options.

Our Stock Option Tax Calculator automatically accounts for it. Ad How To Trade Options will change how you invest your money - receive it today. Lets explore what it means to exercise stock options the taxes you may need to pay and the common times people exercise their.

You own 10000 options one share per option to purchase common stock in your. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant.

How To Use The Exercise Simulator In Your Carta Portfolio

Changes To Accounting For Employee Share Based Payment The Cpa Journal

When To Exercise Stock Options

When To Exercise Your Employee Stock Options

How Stock Options Are Taxed Carta

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-03-4346254c24b54206b3dda8692d4f0f7c.jpg)

What Is An Employee Stock Option Eso

How Stock Options Are Taxed Carta

Stock Option Financing In Pre Ipo Companies

/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

Employee Stock Options Financial Edge

How To Use The Exercise Simulator In Your Carta Portfolio

Exercise Cartoon 808 Andertoons Exercise Cartoons Gym Humor Gym Clothes Cheap Biking Workout

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-02-e2a3aeb7d91347578e72df8195d0e8f0.jpg)

Get The Most Out Of Employee Stock Options

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

Tax Planning For Stock Options

/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)